Cashback App Development Like Upside: A Complete Guide for 2025

- Riya Thambiraj

![Riya Thambiraj]()

- Customer Loyalty

- Last updated on

Everyone loves getting money back. But for founders and brands, cashback apps offer something even more valuable, growth that pays for itself.

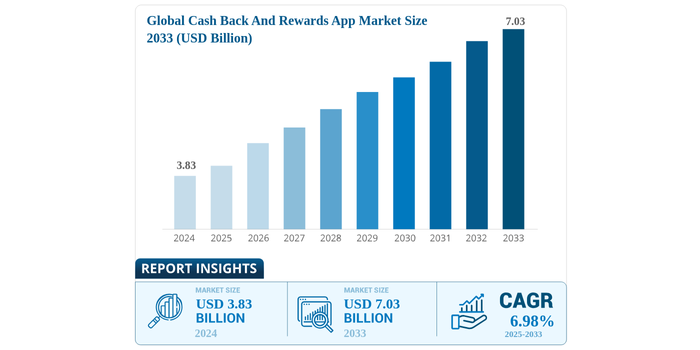

In 2025, cashback platforms have evolved into powerful tools for driving customer loyalty, increasing retention, and unlocking new revenue streams. With the global market projected to hit $22.7 billion by 2032, the opportunity is massive, but so is the competition.

Source: Credence Research

Who is this article for?

If you're a startup founder, a lean product team, a growth-focused product manager, or part of a CXO leadership group exploring loyalty, retention, or innovative digital products, this guide is tailored for you.

We also specifically address senior marketing leaders such as VPs of Marketing, Digital Marketing Heads, and Activation Managers at leading FMCG, DTC, and e-commerce companies.

If you’re responsible for driving customer engagement, loyalty campaigns, or activation strategies, this guide will provide actionable insights to help you make informed decisions and deliver measurable results.

Whether you’re validating a fresh idea, planning a pilot program, or scaling an MVP into a full-fledged product, no matter where you are in your journey, this guide offers clear, practical advice to build with confidence, speed, and real-world expertise.

Why should you read this?

Because cashback apps have gone from being optional add-ons to essential growth tools.

In fact, leading platforms like Upside have helped users earn over $300 million in cashback rewards, while their merchant partners have generated more than $700 million in additional profit since inception. This highlights the win-win nature of cashback solutions.

With trends like AI-personalized offers, card-linked rewards, and real-time tracking, there’s a new standard for what a great cashback experience looks like.

Understanding the tech, the business model, and the user behavior behind it all can make or break your product decisions and save you months of costly missteps.

Why we put this together?

We’ve been building loyalty and cashback apps across industries for over three years. Some of our clients return every festive season to launch fresh campaigns. Others lean on us to optimize costs and simplify operations after high-traffic cycles.

We have seen what works and what does not up close. That’s why we’re excited to share what we’ve learned, so you can move faster with fewer unknowns.

What we cover?

In this guide, we’ll walk you through:

How cashback apps like Upside actually work

The key features and user flows that matter most in 2025

Tech architecture, integrations, and common pitfalls to avoid

Strategic tips to build a product that is lean, scalable, and user-friendly

A detailed cost breakdown of cashback app development like Upside

How to overcome common challenges faced during development

Business models and monetization strategies that drive success

Pros and cons of outsourcing versus in-house development for cashback apps

Future trends shaping the loyalty and cashback app space

Let’s dive into what it really takes to build a cashback app that’s built to perform and built to last.

What Is a Cashback App and How Does It Work?

A cashback app like Upside helps users save money on everyday purchases. When users buy fuel, food, or other items at partner businesses, the app gives a small percentage back as real money or credits.

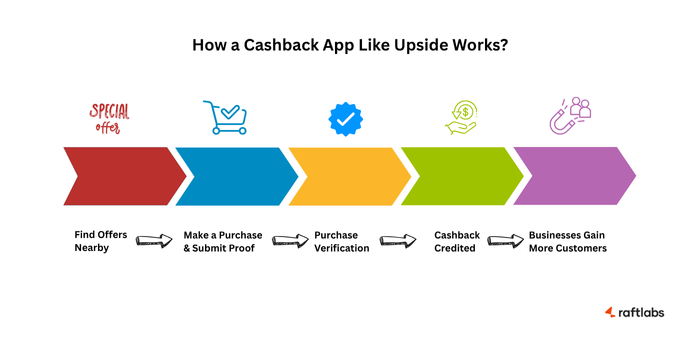

Here's how it works, step by step:

- Users find nearby offers: They open the app, browse cashback offers based on location or category, and select one before making a purchase.

- They make a purchase and submit proof: After the transaction, users either upload a receipt or pay using a linked card, depending on how the app is set up.

- The system verifies the purchase: The app checks the receipt or transaction data to confirm that the offer terms were met.

- Cashback is added to the user’s account: Once verified, the cashback appears in the user’s wallet inside the app. They can later withdraw it or use it toward other offers.

- Businesses benefit from more customers: While users enjoy savings, partner stores see more traffic and repeat purchases through targeted promotions.

When developing a cashback app, it’s important to get the tracking, rewards, and offer systems right.

At RaftLabs, we build cashback apps with smooth flows, scalable systems, and personalized experiences that keep users coming back.

If you’re estimating the cost to build an app like Upside, this flow forms the foundation. Add-on features like real-time tracking, loyalty integrations, or AI-based recommendations can affect timelines and budgets.

Key Features of a Successful Cashback App Like Upside

Once the tech is sorted, the next big thing is getting the features right. These are what users interact with daily. They also define how merchants manage offers and how you, as the platform owner, stay in control.

Features of a Cashback App Like Upside

| User Panel | Merchant Panel | Admin Panel |

|---|---|---|

| Registration & Login | Merchant Onboarding & Login | User & Merchant Management |

| Profile Management | Offer Management | Content Management |

| Cashback Tracking | Performance Dashboard | Transaction Monitoring |

| Transaction History | Redemption Validation | Commission Management |

| Offer Search & Filters | Customer Feedback Access | Report Generation |

| Secure Payment Linking | Payment History | Security & Fraud Control |

| Redemption Options | Support Access | Feedback & Review Management |

| In-App Support | Offer Templates | Announcement Broadcast |

Whether you're building from scratch or just mapping out the MVP, here’s what a successful cashback app like Upside typically includes.

For Users: Keep it simple, clear, and rewarding

The user experience is what makes or breaks a cashback app. The goal is to keep things intuitive and make users feel in control of their rewards.

Easy sign-up and login: Let users register quickly using their phone, email, or social accounts. Fewer steps mean higher completion rates and better onboarding.

Profile and payment settings: Allow users to update personal info, link or unlink cards, and manage notification preferences, all in one place.

Real-time cashback tracking: Once a purchase is verified, users should see their rewards reflected immediately. A visible progress tracker also builds trust.

Transaction history: Give users a clear view of where they earned, how much, and when. Filters for date, brand, or location help with clarity.

Offer discovery with search and filters: Location-based search, category filters, or smart sorting make it easy for users to find relevant deals around them.

Flexible redemption options: Let users redeem cashback via bank transfer, gift cards, or wallet credit. Choice improves retention.

In-app support: Provide easy access to help, whether it’s through FAQs, live chat, or a simple contact form. Quick support helps reduce drop-offs.

For Merchants: Tools to attract, track, and optimize

If your business model includes merchant partnerships, you’ll need a strong merchant dashboard. It helps partners run offers, track impact, and validate redemptions without friction.

Merchant onboarding: Let businesses sign up and get verified with minimal hassle. A guided onboarding flow makes setup smoother.

Offer management tools: Merchants should be able to create, schedule, or edit cashback offers easily based on location, time, or product category.

Performance dashboard: Give merchants a real-time view of offer redemptions, customer visits, and conversion rates. This helps them improve campaigns.

Redemption validation: Allow merchants to confirm that a cashback claim is valid before it's finalized. Helps avoid fraud or mismatched claims.

Customer feedback visibility: Showing user reviews or feedback helps merchants learn what’s working and what’s not.

Payment and earnings view: A transparent log of all payments made and pending, so there’s no confusion over commissions or payouts.

Offer Templates: Allow merchants to reuse or duplicate past offers instead of creating each from scratch.

For Admins: Full control behind the scenes

The admin panel brings everything together. This is where you manage users, merchants, offers, and data. It’s also where you’ll spot problems before users do.

User and merchant management: Add, suspend, or modify accounts. Reset access. Update KYC info if needed.

Content and banner management: Control what shows up on the homepage, offer banners, or notification sections, all without needing a developer.

Transaction and cashback tracking: Monitor every transaction across users and merchants. Spot delays, duplicates, or fraud attempts early.

Commission and payout settings: Set your cut, apply dynamic commission rates, and automate payout rules based on volume or time.

Custom reports and exports: Let the system generate performance reports on cashback redemptions, active offers, or user growth, helpful for both internal teams and investor updates.

Security protocols: Manage authentication rules, fraud alerts, or suspicious activity logs. This is key to long-term trust.

Announcement Broadcast: Push custom messages (like updates, warnings, or promos) to users or merchants from the admin panel.

These features are the foundation of what makes a cashback app work well at scale. Whether you’re focusing only on the user side or planning to support both merchants and affiliate networks, building a cashback app like Upside means thinking through each flow clearly and designing for flexibility.

Types of Cashback Apps You Can Develop

Now that you’ve got a sense of how these platforms work behind the scenes, the next step is deciding which type of cashback model fits your goals.

Not all apps follow the same format, some are built for quick wins, others for long-term engagement. Here's a breakdown of key types:

Receipt-Based Cashback Apps Users upload their purchase receipts to earn rewards. Ideal for FMCG brands and retailers wanting to validate offline sales and drive repeat usage. This model offers deep data on user behavior without needing direct POS integration.

Card-Linked Cashback Platforms Users link their debit or credit cards, and cashback is triggered automatically upon eligible transactions. Great for building a seamless, low-friction experience that works across both online and offline stores.

Partner Network Aggregators These apps aggregate deals from affiliate partners or third-party coupon networks. A lower-lift way to launch if you want quick coverage across categories without managing individual merchant contracts upfront.

Retailer-Owned Loyalty Cashback Apps Retailers use this model to build direct relationships with customers. Cashback rewards are issued for in-store or online purchases, with features like personalized deals, in-app wallets, and gamified milestones.

B2B Cashback or Rewards Systems Used by manufacturers or suppliers to reward channel partners, tradespeople, or business buyers. Helps drive loyalty in industries like construction, logistics, and tools by tying rewards to invoices or proof of purchase.

Travel and Hospitality Cashback Apps Apps that focus on hotel bookings, flight reservations, or dining bills. Often linked to card transactions or email receipts. Useful for platforms targeting frequent travelers or building category-specific loyalty.

Each of these models comes with its own set of benefits and technical considerations. The right choice depends on your user base, growth plans, and monetization strategy.

If you're looking to build a cashback app like Upside, starting with the right format is half the battle.

The Technology Behind Cashback Apps

Behind every smooth cashback experience is a strong tech foundation. To build a cashback app like Upside, you need systems that are fast, secure, and smart enough to handle thousands of daily transactions without breaking flow.

Here's a closer look at the core tech components.

1. Payments and Transaction Tracking

Cashback apps depend on accurate, real-time tracking of purchases. That starts with seamless payment integrations and card-linking systems.

Users link their debit or credit cards once. Every qualifying payment is tracked automatically, without uploading receipts.

The app integrates with platforms like Stripe, PayPal, or mobile wallets to process payments securely and instantly.

These systems make the cashback experience smooth for users and reliable for your business partners.

2. Security and User Trust

Handling payment data comes with responsibility. Strong security protocols are non-negotiable when developing a cashback app.

All personal and payment data is protected using end-to-end encryption to maintain privacy and trust.

Two-factor authentication and secure login standards like OAuth 2.0 and JWT reduce the risk of unauthorized access.

These safeguards help build confidence, especially when users are linking sensitive financial information.

3. Real-time Backend Architecture

A scalable backend is what keeps everything running smoothly especially when you're tracking cashback across multiple users, locations, and merchants.

We use cloud services like AWS or Google Cloud to create infrastructure that can grow with your user base.

Real-time transaction processing ensures users see their rewards reflected almost instantly after a valid purchase.

Databases like PostgreSQL or MongoDB allow fast, secure access to user profiles, offer data, and payment records.

4. Partner Integrations and Offer Management

To build a cashback app that stays dynamic, you'll need solid integrations with affiliate networks and merchant systems.

APIs connect the app to affiliate platforms, making it easy to pull new offers and manage cashback commissions.

Merchants can log in to dashboards where they track offer performance and approve redemptions in real time.

Automated reconciliation systems reduce manual work, ensuring accurate payouts to users and partners alike.

5. AI for smart recommendations and fraud checks

The more intelligent your app, the better the user experience. AI makes your cashback app more engaging and more secure.

Machine learning models suggest personalized offers based on user activity, increasing chances of redemption.

The same systems detect abnormal transaction behavior, helping flag or block fraudulent patterns early.

Over time, the system improves as it learns, making the app smarter with each interaction.

6. Emerging Tech for Next-Gen Experiences

If you’re looking to stand out, new technologies are opening fresh ways to build engagement.

Some companies are using blockchain for transparent reward tracking and even crypto-based cashback.

AR features allow users to discover local deals by scanning in-store items, while geofencing pushes hyper-local offers.

When developing a cashback app, it's worth investing early in a tech stack that can scale, adapt to changing user behavior, and support real-time rewards without friction. That’s what sets successful apps apart as they grow.

| Component | Purpose | Common Tools / Tech |

|---|---|---|

| Card-Linking | Automatically track purchases without receipts | Visa/MC APIs, Fidel API |

| Payment Integration | Process secure payments and support wallets | Stripe, PayPal, Braintree, Apple Pay, Google Pay |

| Encryption & Security | Protect user data and prevent fraud | End-to-End Encryption, OAuth 2.0, JWT, 2FA |

| Real-Time Cashback Tracking | Calculate and show cashback instantly | AWS, GCP, Azure, PostgreSQL, MongoDB |

| Affiliate Network APIs | Fetch dynamic offers and manage referral payouts | Rakuten, Commission Junction, Impact.com |

| Merchant Dashboard | Allow partners to manage offers and track performance | Custom Web Portals with Admin Roles |

| AI Personalization | Show relevant offers based on user behavior | Python ML Models, TensorFlow, AWS Personalize |

| Fraud Detection | Monitor suspicious activity and reduce abuse | Rule-based + ML-based detection models |

| Emerging Features | Enhance UX with next-gen functionality | Blockchain, Geofencing, AR SDKs |

Step-by-Step Cashback App Development Process

Now that you know what your cashback app needs to offer, the next question is simple: how do you actually build it?

We’ve worked with startups and teams who’ve gone from raw ideas to working products without getting stuck in endless planning loops.

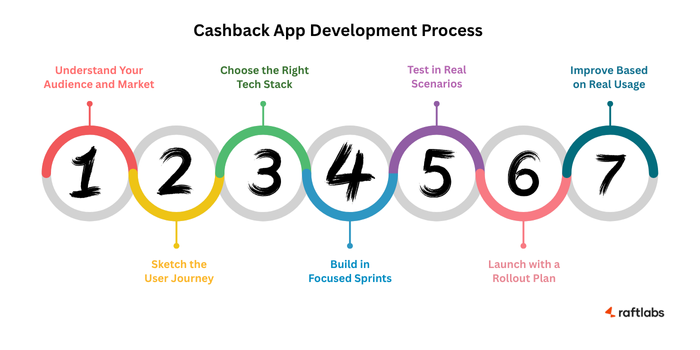

Here’s the step-by-step process we follow to build a cashback app like Upside.

1. Understand your audience and the market

Before anything else, get clear on for whom you're building. Research what users expect, what your competitors do well, and where the gaps exist. This is the stage where you define your edge: what makes people pick your app over others.

2. Sketch the user journey

Once the core idea is clear, we turn it into wireframes. Think of this as a clickable sketch of the app. You’ll see how a user signs up, finds an offer, earns cashback, or redeems rewards. Simple flows here save you from expensive rework later.

3. Choose the right tech stack

You don’t need to overbuild, you just need to choose the best tech stack for you app, that includes backend tools, databases, and third-party integrations based on what your app actually needs. If card-linking or real-time cashback tracking is core, that goes in early.

4. Build in small, focused sprints

Development runs in 2-week blocks, with each sprint focused on a working feature like wallets, merchant dashboards, redemption flows, and more. You get regular progress demos so the product doesn’t drift from your vision.

5. Test in real scenarios

This is where quality shows. We test across devices, slow networks, and real user paths. From edge cases to cashback accuracy, every step is validated to avoid user frustration post-launch.

6. Launch with a proper rollout plan

Once stable, the app goes live across app stores. But launch isn’t just uploading the build. It includes user onboarding, help docs, basic analytics setup, and the first wave of marketing support to get early users in.

7. Improve based on real usage

After launch, things get real. Users ask for features. Bugs show up in the wild. We help you track, prioritize, and ship improvements that matter. It’s more than just keeping things running; it’s about building on your progress and moving forward.

That’s how we handle cashback app development at RaftLabs, one step at a time, with full clarity at each stage.

Also Read: Loyalty App Development Companies for Startups

Benefits of Cashback App Development Like Upside

After launch, a cashback app does more than just reward users. It becomes a key part of how you grow, retain, and understand your customer base.

For founders, agencies, and enterprise teams exploring this model, here’s what makes it worth the investment.

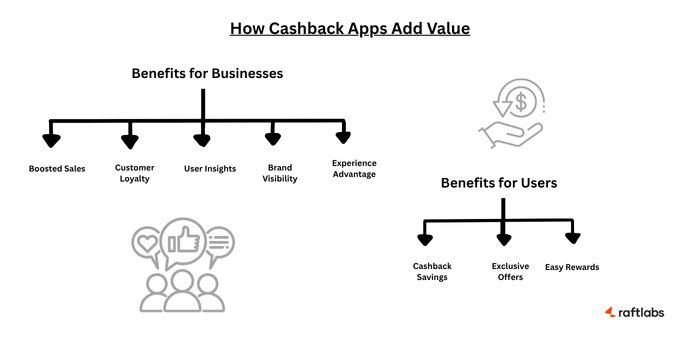

Benefits for Businesses

Increased sales and higher purchase volume: Cashback offers push customers to spend more. For some brands, sales jumped 20 to 30 percent after rolling out targeted cashback deals.

Repeat customers and stronger loyalty: Once users know they can earn on every transaction, they’re more likely to return. Cashback builds a habit, one that’s hard to break.

Actionable customer insights: Every transaction gives you real data. You can learn what users buy, when, where, and how often. That powers better targeting and smarter offers.

Improved brand recall and visibility: Offering tangible rewards helps your brand stand out in competitive markets. It adds value beyond price and builds long-term perception.

Competitive edge with better experience: Smooth user flows, fast redemptions, and exclusive offers give you a functional edge. Especially in sectors where products feel similar.

Benefits for Users

Money back on regular spending: Users earn cashback on purchases they already plan to make. It feels like saving without changing behavior.

Exclusive deals and partner offers: Cashback apps often provide access to deals users won’t find elsewhere, increasing perceived value.

Simple, user-friendly savings: A clean app experience makes it easy for users to browse offers, earn rewards, and redeem them without confusion.

As a business, developing a cashback app like Upside is a strategy shift. You're giving people a reason to return while collecting data that improves your next offer. And for users, it’s one of the few reward systems that feels instantly useful.

Why Invest in Cashback App Development?

The upside of building an app like Upside goes beyond just cashback. It’s about designing a product that adds real value to your users and builds consistent value for your business. If you’re thinking long-term, here’s why this is worth your time and resources.

Tangible ROI for Both Sides Cashback apps create a win-win: users save money while businesses see higher conversions and repeat purchases. With every transaction tracked, it’s easier to attribute ROI to specific campaigns and partners.

Data-Backed Customer Insights Every tap, scan, and redemption gives you a clearer view of customer behavior. This data powers smarter marketing, better retention strategies, and personalized offers that improve lifetime value over time.

Built-In Growth Loops Referral programs, gamified rewards, and daily streak bonuses aren’t just fun—they create natural user acquisition and engagement loops that reduce CAC while keeping users hooked.

Brand Stickiness Without Discounts Unlike flat discounts, cashback offers feel like earned rewards. This subtle shift changes how users engage with your brand, encouraging loyalty without constant price cuts.

Future-Proofing Through Personalization and AI As the market matures, users expect more tailored experiences. A well-built cashback app lays the groundwork for AI-driven recommendations, location-based offers, and predictive engagement strategies that can evolve with your product.

B2B and Vertical Expansion The same mechanics used in B2C cashback platforms apply in B2B loyalty, events, healthcare, and even logistics. A solid cashback foundation gives you room to expand across verticals without starting over.

In short, developing a cashback app is about building a feedback loop between your product, your customers, and your growth engine along with giving back something to your loyal customers. If you're planning to build a cashback app like Upside, this is one investment that compounds over time.

Calculate My Loyalty Profit & ROI for Free

See exactly how much profit you can generate from your loyalty program. Measure the impact on revenue, retention, and customer engagement instantly without any guesswork.

Business Models & Monetization Strategies for Cashback Apps

Once your app is live and users start transacting, the big question is how it makes money. A cashback app like Upside doesn’t rely on a single revenue stream.

It uses a mix of models that balance user incentives with platform growth. Here’s how we look at it when helping teams build sustainable cashback platforms.

1. Affiliate commissions (core revenue)

This is the main driver for most cashback platforms. Your app partners with merchants or affiliate networks. When users shop through your app, you earn a commission for the referral. You keep a portion as profit and pass the rest to the user as cashback.

Low setup cost, easy to scale

Works well for both direct brand deals and affiliate aggregator networks

The more users and purchases, the stronger your revenue base

This is how apps like Upside and Rakuten generate consistent income across categories like fuel, groceries, travel, and retail.

2. Premium memberships and subscriptions

You can offer a paid tier for users who want more benefits like higher cashback rates, faster payouts, access to exclusive deals, or an ad-free experience.

Builds recurring revenue

Helps identify and retain your most loyal users

Works well when your app has a high-frequency use case

Top cashback and similar platforms use this model to increase average revenue per user while rewarding power users.

3. In-app ads, sponsored offers, and data insights

These models are often used in combination to support early monetization and growth.

In-app ads: Show banner or rewarded video ads to free users

Sponsored offers: Merchants pay for premium visibility in your app

Data monetization: Aggregate, anonymized data helps brands improve their own targeting

This works best when you have a large, active user base. It also lets you monetize users who browse but don’t transact often.

4. Referral programs and gamification

To grow faster without spending too much on ads, you can turn users into promoters.

Reward users who refer others with bonus cashback or credits

Add gamified elements like points, leaderboards, or streaks to boost custom engagement

This not only increases your user base but also improves retention. Dropbox, Uber, and Airbnb have all grown using similar tactics.

A cashback app like Upside usually blends two or three of these models based on the user base and growth stage.

| Monetization Strategy | How It Works | Best Used When |

|---|---|---|

| Affiliate Commissions | Earn a % from partner stores for each user purchase, share part as cashback | You want low upfront cost and scalable revenue |

| Premium Memberships | Users pay for perks like higher cashback, no ads, or early access deals | You have loyal users who engage frequently |

| In-App Ads | Show ads to free users, earn per view or click | You need to monetize non-paying users |

| Sponsored Offers | Merchants pay to feature deals or run promos inside the app | You’ve built merchant trust and active traffic |

| Data Monetization | Sell aggregated insights on spending behavior (privacy maintained) | You have a large user base and clear data trends |

| Referrals & Gamification | Users earn rewards for inviting friends or completing tasks | You want viral growth and stronger retention |

Cost Breakdown of Cashback App Development Like Upside

By this point, you probably see the opportunity. A cashback app like Upside doesn’t just create value for users, it drives retention, growth, and partnerships that scale.

But turning that idea into a working product means navigating budgets, trade-offs, and technical decisions. And that’s where most teams hit their first wall.

You don’t want to under-plan and lose users with a buggy first version. But you also don’t want to overbuild and drain resources before getting feedback. That’s why breaking down the costs into stages can help you build smart, stay lean, and grow with clarity.

Here's how rewards and loyalty app development companies typically approach it when helping teams move from idea to product.

| Development Stage | Key Inclusions | Estimated Cost Range (in USD) |

|---|---|---|

| UI/UX Design | User research, wireframes, clickable prototypes, branding | $5,000 – $50,000 |

| Backend & API | Server setup, databases, login, cashback logic, affiliate APIs | $5,000 – $100,000+ |

| Frontend Development | iOS/Android app, admin/merchant dashboards (web or mobile) | $15,000 – $75,000 |

| Third-Party Integrations | Stripe, PayPal, affiliate networks, analytics tools | $10,000 – $30,000 |

| Testing & QA | Manual testing, automation, cross-device checks | $8,000 – $18,000 |

| Deployment & Maintenance | App store deployment, cloud hosting, support, monitoring | 15–25% of total dev cost/year |

| Total Estimated Range | Based on scope and scale | $30,000 – $250,000+ |

1. UI/UX Design

This is the first impression, and it counts. The cleaner your app feels, the more users will trust it. And with cashback apps, trust is everything.

Design research, wireframes, and prototyping: This is where you validate the user journey before writing a line of code.

Basic app design starts at $5,000 to $15,000

Custom flows, brand visuals, and motion design can push this to $20,000 to $50,000+

If you’re building in a crowded market, this is often the area that separates you from “just another rewards app.”

2. Backend & API Development

Think of this as the foundation of your product. It handles real-time cashback calculations, secure user data, login systems, and everything your users never see, but always feel.

Scalable backend with strong database architecture

API integrations with affiliate platforms, payment gateways, analytics tools

Simple backend setups: $5,000 to $20,000

Complex, future-ready architecture: $25,000 to $100,000+

Skimping here usually shows up later as downtime, data errors, or user complaints. It’s better to get this part right from the start.

3. Frontend Development

This is what your users and partners interact with daily, your mobile apps and dashboards. Whether you go cross-platform or native depends on your goals, timeline, and budget.

Cross-platform mobile apps (Flutter, React Native): $15,000 to $40,000

Native apps + responsive admin/merchant web dashboard: $50,000 to $75,000

Dashboards might feel secondary, but partners and internal teams rely on them for offer management, reporting, and support. Building both user-facing and back-office flows in parallel saves headaches later.

4. Third-Party Integrations

Cashback apps can’t function in isolation. To build something like Upside, your system needs to plug into external tools smoothly.

Payment gateways like Stripe or PayPal

Affiliate platforms like Rakuten, CJ, or direct merchant APIs

Analytics tools like Mixpanel or Firebase

Typical integration cost: $10,000 to $30,000 depending on complexity

These integrations are essential for your app’s credibility and for tracking what’s working from day one.

5. Testing and QA

This is where many MVPs fall short. A crash during checkout or a broken cashback notification can destroy trust instantly. Testing gives your users confidence and your team fewer fire drills post-launch.

Manual and device-based QA: $8,000 to $12,000

Full coverage with automated regression testing: $15,000 to $18,000

We always recommend testing across different OS versions, device types, and network conditions. Cashback apps deal with real money, so small bugs can cause big problems.

6. Deployment & Maintenance

Shipping the app to stores is just the start. Keeping it fast, secure, and up-to-date is where the real work begins.

Initial cloud setup and store deployment is included in most builds

Ongoing support usually costs 15–25% of the total development cost per year

So if your full app costs $100,000, you should plan around $15,000 to $25,000 per year for monitoring, patches, server upgrades, and small feature updates.

Overcoming Common Challenges

Even with a solid budget and clear vision, building a cashback app comes with its share of challenges.

From handling sensitive data to keeping users engaged long-term, there are plenty of moving parts.

Here’s how we help teams navigate the roadblocks that often come up during cashback app development.

1. Standing out in a crowded space

There’s no shortage of cashback apps in the market. What separates a forgettable one from a successful product is clarity of focus.

The cashback app Upside began by targeting users looking to save on fuel purchases, focusing on that strong, single use case before expanding into other categories like groceries and dining.

Similarly, as a loyalty app development company, we recommend starting with a clear focus on a specific category or problem to build traction and deliver real value from day one.

Forming early merchant partnerships, integrating exclusive deals, or supporting hyperlocal offers can also help build early traction in a space that feels competitive.

2. Acquiring and retaining users

Getting users to download your app is only half the battle. Keeping them active is where things get tricky. Cashback isn’t enough on its own, you need to build engagement into the experience.

Personalized offers based on past purchases

Referral bonuses that reward both users

Small gamified nudges like streaks, progress bars, or surprise rewards

These techniques not only increase repeat use but also build long-term habit loops.

3. Managing technical complexity

Behind the scenes, cashback apps rely on multiple systems talking to each other like affiliate networks, payment gateways, and real-time transaction tracking. It’s easy to underestimate the effort needed here.

To avoid breakdowns, we focus on modular architecture, stable APIs, and robust logging. This way, if one connection fails, the whole app doesn’t fall apart.

4. Ensuring compliance from day one

Handling payments and personal data means you’ll need to meet legal and compliance standards, especially if you plan to operate across regions.

GDPR or similar data privacy policies

Secure authentication and encryption

Compliance with payment processing rules (PCI-DSS, etc.)

Working with the right tech team helps you get these sorted during development, not after launch when it’s harder and more expensive to fix.

5. Preventing fraud and abuse

Cashback platforms are often targeted by people trying to game the system. Fake transactions, bot accounts, or abuse of referral codes can burn your budget fast.

We use a mix of rule-based filters and machine learning models to flag suspicious activity. Adding redemption validation and usage limits can also help you stay one step ahead.

No product is challenge-free. But building a cashback app like Upside is absolutely possible with the right strategy, guardrails, and technical planning. At RaftLabs, we’ve seen that most of these hurdles can be handled early, as long as they’re not ignored during the build.

Outsourcing vs. In-House Development for Building A Cashback App

After scoping out features and budgeting for your cashback app, the next decision hits: who’s actually going to build it?

For many founders and product leads, this is where clarity fades. You want control, but you also want speed. You want quality, but your current team is already stretched. And hiring a full dev team in-house feels like a long, expensive road.

Let’s break it down based on what we’ve seen work across real-world builds especially for those trying to move fast without cutting corners.

When Outsourcing just makes sense

If your internal team is focused on growth, go-to-market, or strategy, outsourcing the build can help you keep momentum without burning out. You get a full product team with engineers, designers and QA, without building it all from scratch.

We’ve seen this work best when:

Time-to-market matters more than full control

Your team doesn't have deep experience in cashback or fintech

You need flexibility to scale up during dev, and scale down post-launch

You want to move forward without waiting three months to hire the perfect backend lead

That said, outsourcing only works well when there’s clarity. A good partner challenge assumptions, flag risks early, and build like your internal team would.

At RaftLabs, we start projects asynchronously with shared docs to align on goals, timelines, and expectations.

Communication happens primarily on Slack, task management runs through Asana, and we hold daily stand-ups via Google Meet. No micromanagement required, you stay focused on business priorities while we drive the build forward with clarity and momentum.

When going in-house is the right move

There are cases where building internally is the better call, especially if you already have a strong engineering culture or see this product as core to your long-term IP.

We’ve seen in-house teams succeed when:

The product needs constant iteration based on user behavior

You already have an engineering team that’s deeply involved in roadmap decisions

Your hiring pipeline is strong, and you're okay with longer timelines

You plan to build new features every month after launch, and want tight alignment

But going fully in-house comes with trade-offs. Higher salaries, longer hiring cycles, slower ramp-up, and the pressure to retain and manage a full team, even during slow periods.

If you’re still early, it might make more sense to co-build with a product team like ours first, then gradually bring roles in-house once there’s traction and clarity on what the next phase looks like.

Outsourcing is like bringing in a skilled product team when you need speed, direction, and deep experience. It helps you move forward faster without the pressure of hiring, training, or managing everything internally.

In-house is more like setting up your own studio. It gives you full control but takes longer, costs more, and requires the right team already in place. For many teams, this makes sense only after launch, when the product is stable and growing.

If you're planning to build a cashback app like Upside and are still working through payments, affiliate integrations, or mobile app flows, partnering with a team experienced in loyalty app development can save you months of trial and error. You stay focused on strategy while we build the product right from the start.

Why Work with RaftLabs to Build a Cashback App

By now, you’ve seen what it takes to build a cashback app like Upside. It’s not a simple build. You’re dealing with transaction flows, partner integrations, real-time tracking, and a product that needs to work smoothly across multiple touchpoints.

We’ve helped teams build loyalty and cashback platforms that not only launch but keep running well as usage grows. Here’s how we usually support that journey.

We’ve worked on reward products before

We’ve built receipt-based rewards apps for events and FMCG brands. We’ve also helped B2B platforms drive repeat usage with point systems and monthly campaigns. In one case, over 2,000 users signed up in the first week. In another, we saw over 60% improvement in repeat engagement after launch.

These experiences have shaped how we approach cashback flows, user trust, and merchant-side logic. It also means we don’t need to learn everything from scratch when you come to us with an idea.

We stay involved from planning to post-launch

Most builds start with a rough idea or early feature list. We help you shape that into a working MVP, balancing priorities based on timeline, budget, and go-to-market plans.

After launch, we don’t disappear. We track what’s working, help fix what’s not, and stay around to support iterations, whether it’s for performance improvements or a new referral loop that needs testing.

We build with speed, but not at the cost of quality

We work in short sprints and move fast. But we also slow down when needed, especially around payments, cashback validation, or user-facing reward logic. These are the areas that directly impact trust.

That balance of speed and care is what makes builds smoother. You don’t lose momentum, but you also avoid patching problems later.

We don’t overcomplicate things

You won’t get a bloated product with unnecessary modules. We focus on the pieces that serve your goals. If something can wait, we’ll say so. If something is likely to break under real load, we’ll flag it early.

Our aim is simple: build what’s needed, in a way that gives you room to grow without major rewrites later.

Future Trends in Cashback and Loyalty Apps

If you’re building a cashback app like Upside or Fetch, it helps to not just solve today’s needs but to prepare for what’s coming next. Loyalty is changing fast, and the apps that adapt early tend to build stronger user habits and deeper partnerships.

Here are a few trends we’re watching closely at RaftLabs.

Smarter rewards with AI and personalization

Cashback apps are becoming more dynamic. With AI and machine learning, offers can now adapt based on what users actually buy, when they shop, and what they tend to ignore.

Apps are already using AI to personalize cashback deals in real time

Brands have seen stronger email open rates and better conversions with AI-backed targeting

AI can also flag churn risks early and help recover disengaged users with timely offers

Personalized rewards are no longer a bonus. They’re becoming baseline.

Blockchain is starting to shape loyalty infrastructure

Security and trust matter a lot in cashback systems. Blockchain brings transparency by recording transactions in a way that’s hard to tamper with.

Some companies are using blockchain to create loyalty currencies that work across multiple brands

Others are exploring crypto-based cashback systems that let users redeem tokens anywhere in the network

While still early, the technology offers promise for apps focused on cross-brand collaboration or international users

It’s not a must-have today, but something to plan for as ecosystems grow.

Omnichannel cashback is becoming the standard

Users no longer shop in just one place. They expect rewards across channels like mobile apps, web, in-store and they want it to feel seamless.

Leading platforms are already supporting web, app, and browser extensions

Users expect to combine cashback with coupons and other rewards in a single flow

Real-time tracking and instant reward visibility across all touchpoints is now seen as the default, not a nice-to-have

This is especially important if your app will support both online and retail partnerships.

New verticals are opening up

Cashback apps are expanding into industries where loyalty wasn’t traditionally tracked. This opens up new opportunities if you’re building for a niche segment.

In travel and dining, users now earn automatic cashback on hotels and restaurants by linking their cards

In healthcare, rewards are being tied to pharmacy purchases or wellness-related spending

In B2B, companies are building cashback systems for suppliers, dealers, or distributors to improve retention and repeat business

But always remember that even though these use cases may need different flows, the core logic of earn, track and redeem stays the same.

Where to Go from Here

Building a cashback app like Upside isn’t just about launching an app. It’s about creating something that users come back to, that partners trust, and that your team can scale with clarity.

Throughout this guide, we’ve walked through the core decisions that shape that journey, how these apps work, what features matter most, what it actually costs to build, and how to stay ahead as the space evolves.

There’s no perfect path, but there are patterns. Apps that succeed tend to be the ones that stay focused on user experience, build only what’s essential in the early stage, and work with teams that understand both the product and the market. They balance speed with trust, and short-term launches with long-term growth.

If you're considering your next move, here’s a simple tip. Start with a clear vision. Make sure your model makes sense. And work with people who’ve built in this space before because loyalty products are about much more than just features.

At RaftLabs, we’ve helped teams go from early an idea to a working app, and from MVP to scale. If you’re exploring something similar, we’d be happy to connect, share what we’ve learned, and see where it leads. Reach out when you’re ready.