Fintech AI Development Services

We build AI-powered fintech products that are fast, reliable, and ready to scale. From predictive analytics to intelligent automation, our solutions integrate smoothly with your existing systems and workflows, so you can focus on growth, not complexity.

Automate repetitive tasks with AI and RPA (Robotic Process Automation) to cut operational costs.

Improve customer experience with 24/7 chatbots and personalized insights.

Make smarter decisions using real-time data and predictive analytics.

Our Fintech AI Development Services

We design and build AI-powered fintech apps that solve real business problems. Everything is tailored to your needs. No generic platforms. No bloated features. Just smart, clean solutions that support growth and reduce manual effort.

Custom AI-Powered Fintech App Development

We build custom full-stack fintech apps like digital wallets, trading dashboards, or lending platforms.

It helps in automates workflows, surfaces insights, and powers decision-making, and we ensure that our solutions align with your business objectives and drive operational efficiency.

MVP Development for Fintech Products

We turn your fintech idea into a working Minimum Viable Product (MVP) that’s ready for real-world use.

Our process focuses on building essential features first, so you can test functionality, gather feedback, and move faster without overbuilding. This lean approach helps you validate market fit and scale with confidence.

Intelligent Chatbots and Virtual Financial Assistants

We create AI chatbots that handle onboarding, support, and financial advice.

They’re fast, accurate, and available 24/7. It reduces the support load for you and give users a better experience across every touchpoint.

Fine-Tuning Large Language Models for Finance

We customize Large Language Models to work with your specific financial workflows.

By training them on your internal data and terminology, we improve their ability to handle tasks like document classification, fraud detection, and client interactions.

You get smarter, context-aware AI product that fits seamlessly into your business operations.

AI Agent and Copilot Development

We build intelligent AI agents and copilots designed specifically for fintech workflows. These AI systems assist with automating financial tasks, analyzing data, and supporting users in real time.

From managing customer interactions to helping internal teams make faster decisions, our AI copilots adapt to your operations and boost productivity across the board.

AI-Powered Fraud Detection and Prevention

We build intelligent fraud detection systems that operate in real time, identifying suspicious behavior, blocking fraudulent transactions, and continuously learning from new threats.

These systems help in reduced risk, minimal losses and provide seamless user experience by protecting their customers from cyber threats.

Generative AI for Fintech Innovation

We develop GenAI-powered systems using advanced models like Claude to build tools for financial advisory, risk prediction, and portfolio insights.

These AI solutions help you automate complex decisions, enhance customer experiences, and bring intelligent features to your fintech products.

mPOS (Mobile Point-of-Sale) Solutions

We design mobile checkout tools that think on the fly. Voice commands, smart inventory prompts, customer insights, and fraud detection, packed into a clean, simple interface. Perfect for fast-moving retail.

AI-Driven Customer Experience Platforms

We build platforms that personalize user journeys.

From product recommendations to automated support, every interaction gets smarter over time. That means better engagement and higher retention.

Types of Fintech AI Solutions We Develop

We design and build AI-powered fintech solutions that solve real problems. Whether you’re launching a new product or upgrading existing systems, we help you bring AI features to life with a focus on speed, accuracy, and a great user experience. Every solution is built for real-world use, not just theoretical performance.

Accounting Management Software

We build AI-driven accounting tools that help you track digital assets, manage cash flow, and stay compliant.

These systems handle tasks like reconciliation, forecasting, and reporting while surfacing real-time insights. You can reduce manual effort and make faster, more accurate financial decisions.

Portfolio Management Solution

We create portfolio systems that use AI to monitor assets, assess risk, and provide live performance updates.

The platform gives users clear recommendations based on market data and portfolio goals. It helps investors stay focused and make better choices, even in volatile markets.

Payment Software

Our payment systems support secure, smooth transactions across mobile, web, and integrated platforms.

With built-in fraud detection and adaptive transaction flows, your users get a seamless payment experience. You maintain control and compliance without slowing things down.

Wealth Management Software

We develop AI-powered wealth platforms that make asset tracking and financial planning easier. Features like portfolio analysis, goal planning, and risk assessment are built into an intuitive interface.

This gives advisors and clients the tools they need to make informed decisions and stay on track.

Intelligent Chatbots

Our AI chatbots use natural language processing to support users around the clock. They answer questions, guide users through processes, and provide personalized financial advice.

These AI tools reduce support load and improve customer experience without needing extra resources.

InsurTech Software Development

We build intelligent insurance tools that speed up underwriting, claims processing, and fraud detection.

AI analyzes user data in real time, automates identity checks, and connects with third-party services.

The result is a more efficient, responsive system for both providers and customers.

Credit Score & Analytics Software

We develop credit scoring platforms that use AI to deliver more accurate, flexible, and transparent evaluations.

You can build custom scorecards, integrate external data, and analyze risk trends through a single dashboard. This helps lenders and financial institutions make better lending decisions, faster.

Regulatory Compliance Solutions

We create AI tools that automate and manage compliance workflows. From KYC and AML checks to real-time reporting, these systems help you stay on top of regulations without the manual burden.

Everything is audit-ready and built to scale with your business.

Investment Management Solutions

Our investment tools provide real-time insights, performance tracking, and AI-powered forecasting.

You can analyze trends, adjust strategies, and make smarter investment decisions using a system built for clarity and control. Everything is designed to help you act with confidence.

Got a fintech idea you want to validate quickly?

We’ll help you turn your concept into a working prototype—fast. Test core features, get real feedback, and move one step closer to building your fintech product with confidence.

Why AI Matters in Fintech?

Smarter Risk and Fraud Detection

- AI monitors transactions in real time, spotting patterns and flagging unusual activity as it happens.

- It adapts continuously to new threats, improving accuracy without the need for constant manual updates. This means fewer false positives, faster approvals, and stronger security.

Personalization That Works

- AI analyzes behavior, financial history, and intent to make every interaction more relevant.

- It recommends the right products, delivers timely nudges, and offers useful insights. Users get value that feels specific to them, not just another generic push.

Real Operational Gains

- Routine tasks like KYC checks, document processing, and loan evaluations can be fully or partially automated with AI.

- This frees up internal teams, shortens turnaround times, and keeps operations lean without sacrificing quality.

Decisions Without Delay

- AI can process large volumes of data in seconds. It gives fintech teams instant insights from user activity, market signals, or credit data.

- This enables better decision-making in the moment, whether it’s for risk analysis, customer engagement, or portfolio adjustments.

Smarter Customer Support

- AI-powered chatbots and virtual assistants handle customer queries instantly, 24/7. They resolve common issues, guide users through complex processes, and escalate only when needed.

- This improves response times, reduces support costs, and delivers a consistent, helpful experience at scale.

AI Use Cases Across Fintech Segments

Explore how intelligent automation and data-driven systems are transforming fintech. From compliance to customer experience, these use cases show how AI enhances speed, accuracy, and personalization at scale.

Neobanks & Digital Wallets

You can simplify user onboarding, automate KYC and AML checks, and personalize every step of the journey.

We help you verify identities faster, deliver relevant offers in real time, and keep users engaged while staying compliant.

Lending Platforms

Qualify borrowers faster with intelligent credit scoring, real-time fraud detection, and predictive risk models.

You reduce manual reviews, minimize defaults, and make smarter lending decisions at scale.

WealthTech & Investment Platforms

Help users manage their portfolios with personalized recommendations, behavior tracking, and real-time market insights.

You deliver advisory experiences that feel tailored without needing a full analyst team.

InsurTech

Streamline claim processing, detect anomalies early, and reduce paperwork with intelligent document analysis.

You give customers faster resolutions while improving internal efficiency.

RegTech

Automate compliance processes with tools that monitor risk, handle reporting, and flag issues in real time.

You stay aligned with changing regulations without adding extra operational burden.

Blockchain & DeFi Platforms

Strengthen your DeFi product with smarter contract logic, wallet behavior analysis, and automated fraud prevention.

You build trust and transparency into your system from day one.

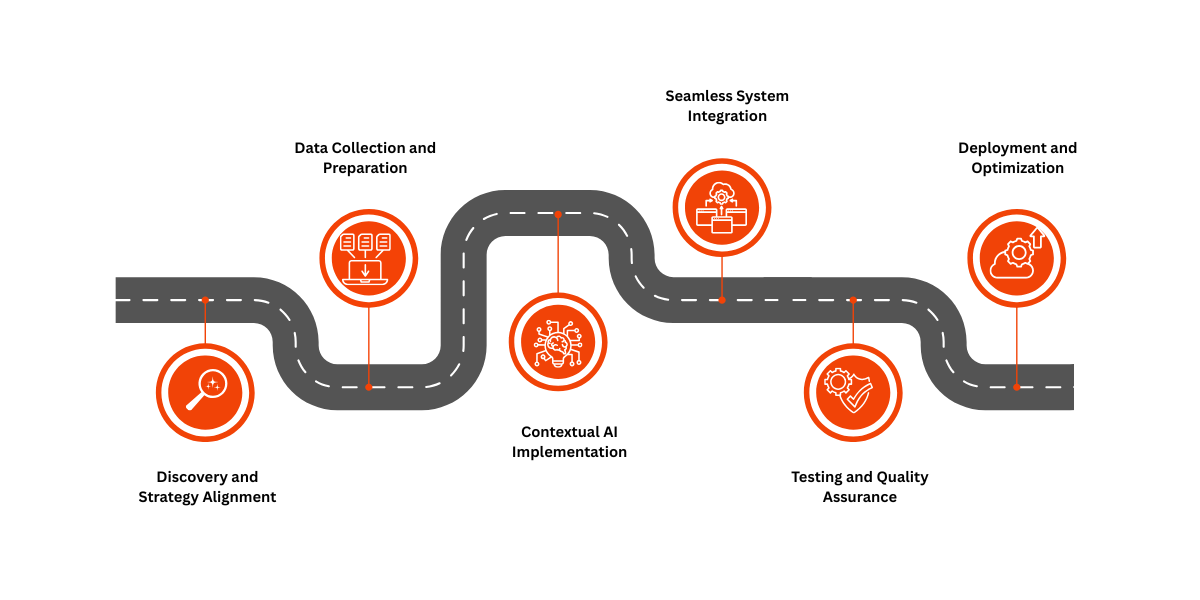

Our Fintech AI Development Process

We follow a proven, step-by-step process to build and deploy AI capabilities that add real value to fintech products. From early-stage discovery to post-launch optimization, our approach is designed to align with financial regulations, integrate smoothly with your existing systems, and scale with your business as it grows.

Discovery and Strategy Alignment

We begin with a focused consultation to understand your business model, user journeys, and regulatory requirements.

This ensures we target the areas where AI can create the most value, whether in risk analysis, automation, or customer engagement.

Deliverables:

Project brief with clear objectives

Initial project roadmap

Requirements document

Data Collection and Preparation

We help you collect, clean, and organize the right financial data.

Proper data preparation is essential to ensure the AI systems produce accurate and relevant results while meeting industry compliance standards.

Deliverables:

Data audit

Data preparation plan

Data preprocessing scripts

A sample dataset for review

Contextual AI Implementation

Instead of building models from scratch, we use trusted pre-trained models and enrich them with your specific business context.

This approach speeds up implementation and delivers domain-relevant results tailored to your fintech use case.

Deliverables:

Interactive prototype

Wireframes

Core model demonstration

Recommendations for improvement

Seamless System Integration

We integrate AI features directly into your existing applications and infrastructure.

Whether it is a mobile banking app or a lending platform, integration is smooth, with no disruption to user experience or internal operations.

Deliverables:

Full-stack AI Development (web/app/integrated)

Custom-built backend logic and AI model configuration

API integrations with CRMs, ERPs, support tools, etc.

Testing and Quality Assurance

Each AI-powered feature is tested under real-world conditions.

We validate for performance, accuracy, scalability, and regulatory compliance before launch to ensure reliable outcomes.

Deliverables:

Functional test reports (unit, system, integration tests)

Security audit checklist (authentication, data protection, access control)

Device and browser compatibility checks

Deployment and Optimization

After deployment, we provide full support for team onboarding and user adoption.

Our team continuously monitors system performance, makes necessary updates, and ensures your AI capabilities stay aligned with changing needs and compliance standards.

Deliverables:

Live product with AI features

Deployment guide

Usage analytics setup

Are you looking for Fintech product development?

What Differentiates the Fintech AI Solutions We Build?

Impressive UI/UX

- Clean, modern interfaces built for ease of use

- Complex tasks simplified for better adoption

- Designed for both finance pros and everyday users

Multiplatform Availability

- Works smoothly on web, Android, and iOS

- Same experience across all devices

- No lag, no broken flows—just consistent access

Multiple Account Management

- Manage multiple accounts from one dashboard

- Clear role-based views and controls

- Easy switching and tracking with full visibility

Advanced Analytics

- Real-time insights from user and transaction data

- Spot patterns, predict behavior, and act fast

- Turn raw data into decisions that matter

Effortless Integration

- Connects easily with your existing systems

- Supports major APIs, CRMs, payment tools, and more

- Keeps workflows intact while adding smart layers

Why Choose Us for Your Fintech AI Development?

Product-Led Tech Expertise

We don’t just build software. We solve real business problems with scalable, AI-powered solutions.

Our team blends deep technical knowledge in AI, machine learning, and NLP with strong product thinking.

Whether you're automating credit checks or building an investment platform, we deliver tools that drive measurable outcomes.

Expertise Across Industries

We’ve worked across industries, building AI-driven platforms for healthcare, hospitality and more.

That cross-domain experience helps us approach fintech problems with fresh ideas and proven technical skills.

Whether it’s streamlining payments or automating compliance workflows, we bring a product-first mindset to every solution.

Fast and Reliable Delivery

We prioritize speed and quality through lean project management and weekly check-ins.

You get predictable delivery timelines and a collaborative workflow that ensures your AI solution goes live when your business needs it most.

Built-In Compliance

Security and data privacy are built into the process from day one.

Whether it’s GDPR or financial compliance standards, we ensure regulatory alignment is part of every solution, keeping your product audit-ready at all times.

End-to-End Development

From strategy and prototyping to launch and post-launch support, we handle every phase.

We help you build with purpose and integrate seamlessly with your existing systems so your fintech product is stable, scalable, and user-friendly.

Agile and Scalable Teams

We work in short sprints and adapt quickly to change.

Whether you're experimenting with a new AI use case or expanding an existing product, our agile process and flexible team structure help you stay ahead of market needs.

Want 24/7 support without scaling your team?

We build intelligent financial chatbots that onboard, advise, and engage, without the wait time.

Our AI Development Case Studies

Your Fintech Development Journey Starts Here!

Get a Free Consultation

Fill out the contact form below and schedule a free consultation call with our experts to discuss your idea.

Get Your Cost Estimate

Our experts will assess feasibility, provide insights, and share a cost & timeline estimate.

Build & Launch

Once finalized, our team gets to work, turning your vision into a fully functional fintech product as required.